Debt consolidation loans with no credit check offer a convenient solution for managing multiple debts by providing a single loan with reduced interest rates, simplifying financial obligations. These loans skip traditional credit checks and instead assess income and debt-to-income ratio, making them ideal for individuals with poor or limited credit histories. However, it's crucial to thoroughly understand terms, rates, and potential risks before applying. Eligibility criteria are key; lenders primarily consider income and current financial commitments rather than credit scores. While accessible, ensuring repayment capabilities is vital to avoid exacerbating financial difficulties. The application process involves research, document preparation, honest disclosure, and communication with lenders. Alternatives like rebuilding credit or secured loans may be more suitable for long-term debt management.

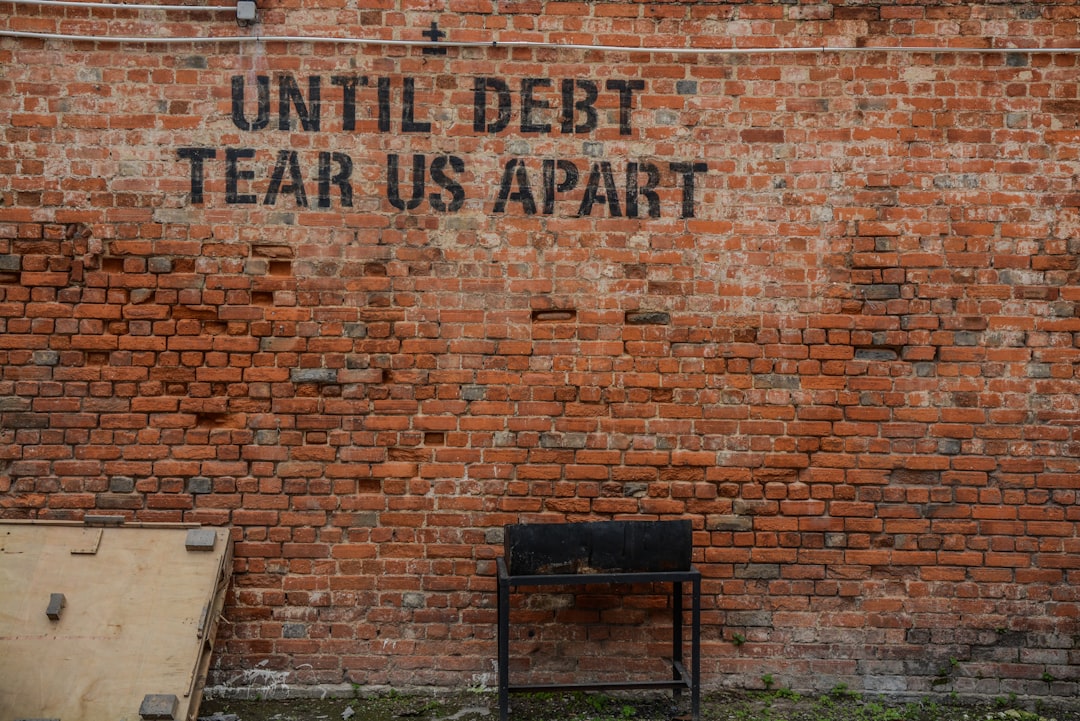

Struggling with multiple debts? Consider Debt Consolidation Loans With No Credit Check as a potential solution for financial freedom. This comprehensive guide breaks down the benefits, eligibility criteria, and step-by-step application process. Learn how these loans can simplify your debt management without the usual credit check hurdles. We’ll also explore alternatives to ensure you make an informed decision tailored to your unique circumstances.

- Understanding Debt Consolidation Loans: A Simple Guide

- The Benefits of No-Credit-Check Loans for Debt Relief

- Who Qualifies? Requirements and Criteria Explained

- Navigating the Application Process Step by Step

- Alternatives to Consider: When a No Credit Check Loan Might Not Be Ideal

Understanding Debt Consolidation Loans: A Simple Guide

Debt Consolidation Loans With No Credit Check offer a simple and effective way to manage multiple debts by combining them into one single loan with a lower interest rate. This can significantly reduce monthly payments, making it easier to budget and potentially save money in the long run. The process involves borrowing a new loan from a lender, which is then used to pay off existing debts, streamlining financial obligations and simplifying repayment schedules.

One unique aspect of these loans is their name—no credit check. Traditional loan applications often require thorough credit checks, but with no-credit-check loans, lenders focus on other factors like income and debt-to-income ratio. This makes them an attractive option for individuals with poor or limited credit histories who are still seeking to consolidate their debts. It’s important to note that while these loans offer a path to financial management, understanding the terms, interest rates, and potential risks is crucial before committing.

The Benefits of No-Credit-Check Loans for Debt Relief

Debt consolidation loans with no credit check offer a unique and beneficial opportunity for individuals seeking debt relief. One of the key advantages is that they provide access to financing without the stringent requirements typically associated with traditional loans. This is particularly advantageous for those with poor or limited credit histories, who might otherwise face challenges in securing a loan from conventional lenders. By removing the need for a thorough credit check, borrowers can bypass potential rejections and gain approval for much-needed debt consolidation funds.

Furthermore, these no-credit-check loans enable borrowers to focus on their financial goals without the added stress of dealing with credit inquiries. It streamlines the application process, allowing individuals to redirect their energy toward creating a budget, making informed financial decisions, and ultimately achieving a more manageable and affordable repayment plan. This approach can be a game-changer for folks looking to simplify their finances and regain control over their debt.

Who Qualifies? Requirements and Criteria Explained

Applying for debt consolidation loans with no credit check can be an attractive option for those seeking financial relief, but understanding who qualifies is essential. These loans are designed to help individuals consolidate multiple debts into a single loan with potentially lower interest rates and more manageable payments. The primary benefit lies in its accessibility; as suggested by the name, these loans often do not require a thorough credit check, making them available to a broader range of borrowers.

To qualify, applicants typically need a stable source of income, such as employment or disability benefits, and proof of identity. Lenders will assess your ability to repay the loan based on your income and existing financial obligations rather than relying solely on credit scores. While this opens opportunities for those with limited credit history or poor credit, it’s crucial to ensure you can meet the repayment terms to avoid further financial strain.

Navigating the Application Process Step by Step

Navigating the Application Process for Debt Consolidation Loans with No Credit Check involves a series of clear, deliberate steps to ensure success. First, research reputable lenders specializing in this type of loan to find one that aligns with your financial needs and offers transparent terms. Many online platforms compare various lenders, making it easier to identify the best fit. Once you’ve chosen a lender, gather essential documents such as proof of income, employment details, and identification. These are typically required for verification purposes.

Next, complete the loan application form accurately and honestly. Provide all necessary information about your existing debts and financial situation. Lenders may not perform a hard credit check, but they will assess your financial health based on the data you provide. Be prepared to discuss your consolidation goals and how the loan will help achieve them. Effective communication can positively impact the lender’s decision. After submitting the application, stay engaged with the lender for updates and be ready to sign the necessary paperwork once approved.

Alternatives to Consider: When a No Credit Check Loan Might Not Be Ideal

While the allure of debt consolidation loans with no credit check is appealing for those seeking financial relief, it’s not always the best option. These loans, as the name suggests, don’t require a thorough review of your credit history, which can be advantageous for individuals with poor or limited credit. However, skipping the credit check might mean higher interest rates and less favorable loan terms compared to traditional debt consolidation options.

There are alternative strategies to consider if a no-credit-check loan isn’t suitable. For instance, building or repairing one’s credit history through responsible financial behavior can lead to better borrowing opportunities in the future. Additionally, exploring secured loans or working with a credit counseling agency to negotiate with creditors could provide more sustainable debt management solutions without the risks associated with subpar interest rates and terms.

Debt Consolidation Loans with No Credit Check offer a viable path to financial relief for many individuals. By understanding the benefits, qualifying criteria, and navigating the application process thoroughly, you can make an informed decision about this alternative financing option. While it’s not always the ideal solution, exploring these loans can help you regain control over your finances. Remember, careful consideration and comparing alternatives is key to choosing the best course of action for your unique financial situation.