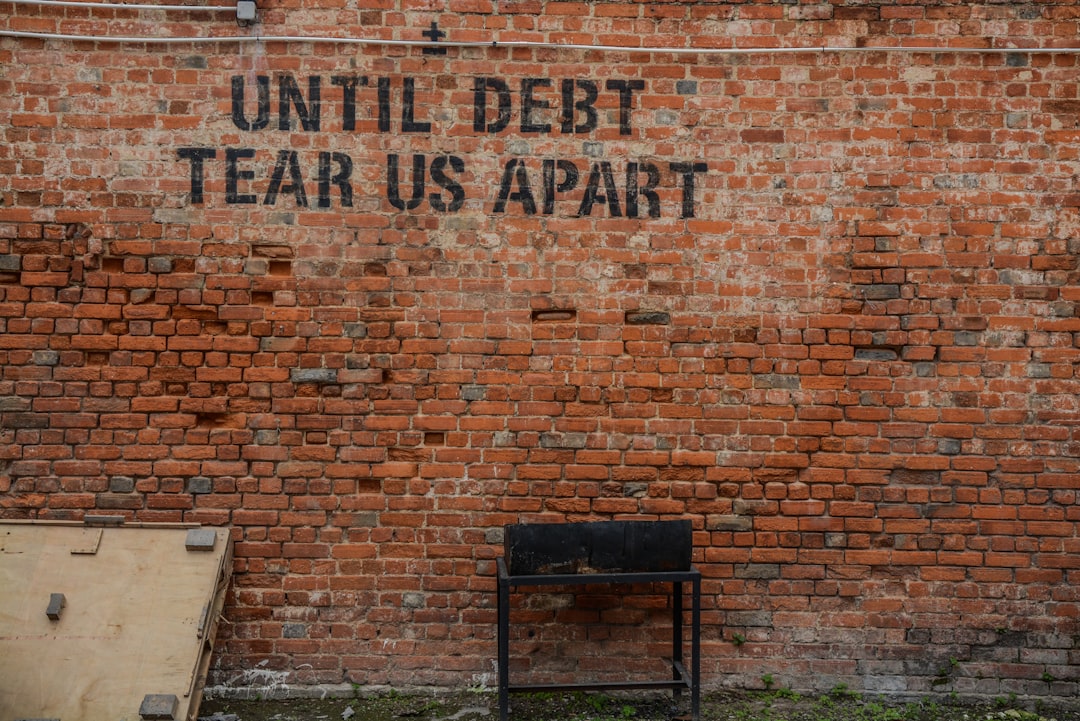

Debt Consolidation Loans With No Credit Check streamline repayment by combining multiple debts into a single loan, potentially lowering interest rates and late fees. This strategy enhances financial well-being, improves creditworthiness over time, and may lead to better loan terms for future borrowing.

Considering a 10K debt consolidation loan? It could be a game-changer for managing your finances. This article explores the benefits of consolidating debts, focusing on ‘Debt Consolidation Loans With No Credit Check’ as a viable option. By streamlining multiple payments into one manageable loan, you simplify debt management and potentially improve your credit score. Learn how this strategy can enhance financial health without stringent credit checks, offering relief and a clearer path to financial freedom.

- Simplify Debt Management: Streamline Multiple Debts Into One

- Improve Credit Score: Potential Benefits For Financial Health

Simplify Debt Management: Streamline Multiple Debts Into One

Debt consolidation loans offer a straightforward and effective way to simplify debt management, especially for individuals burdened by multiple debts. Instead of managing several lenders and varying repayment terms, a 10k debt consolidation loan combines all your debts into one single loan with a single, more manageable payment. This simplifies the process of keeping track of payments and can help reduce late fees associated with missing payments across multiple creditors.

By consolidating debts, you may also be able to secure a lower interest rate than what you’re currently paying on your outstanding balances. This is particularly beneficial for high-interest credit card debts. A debt consolidation loan with no credit check allows individuals with less-than-perfect credit to access this simplified repayment option, providing them with a chance to improve their financial standing over time.

Improve Credit Score: Potential Benefits For Financial Health

Debt Consolidation Loans With No Credit Check can be a game-changer for individuals looking to improve their credit score and overall financial health. By consolidating multiple debts into a single loan, borrowers can simplify their repayment process and potentially reduce interest expenses. This approach allows them to focus on paying off the principal amount more efficiently, which, in turn, positively impacts their credit history.

Furthermore, a successful debt consolidation strategy demonstrates responsible financial management to lenders. As the borrower makes timely payments on the consolidated loan, it reflects well on their creditworthiness, leading to improved credit scores over time. This enhanced credit score opens doors to better loan opportunities and lower borrowing costs in the future, creating a beneficial cycle for long-term financial stability.

Debt consolidation loans, including those without a credit check, offer a strategic approach to managing multiple debts. By combining and simplifying repayment, individuals can gain control over their finances and improve overall financial health. This method allows for better budgeting and the potential to enhance credit scores, paving the way for a more secure financial future.