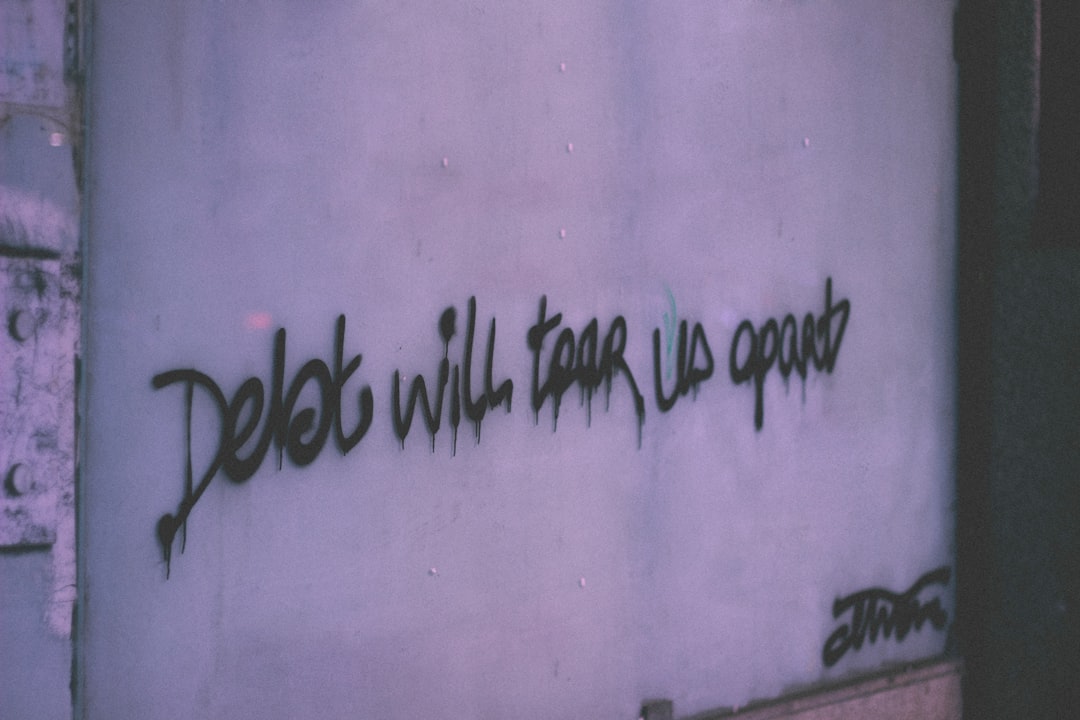

Debt consolidation loans with no credit check provide a financial safety net for individuals burdened by multiple high-interest debts, especially credit card debt. By consolidating these debts, borrowers simplify repayment schedules and potentially reduce overall interest rates. Accessible to those with less-than-perfect credit, these loans offer a chance to improve financial standing over time. However, risks exist as lenders bear more uncertainty without a thorough credit check; thus, careful consideration and alignment with long-term goals are crucial. The application process is straightforward, involving comparison of lenders' rates, documentation, accurate applications, and budget details for successful approval and debt management.

Considering a 10k debt consolidation loan? This comprehensive guide explores the benefits of combining multiple debts into one manageable repayment. We break down no credit check loans, their advantages, potential risks, and application steps. Learn how this strategy can simplify your finances and offer greater control over your debt. Discover if a debt consolidation loan with no credit check is right for you.

- Understanding Debt Consolidation Loans: A Simple Guide

- No Credit Check Loans: How They Work and Who Qualifies

- The Advantages of Consolidating Your Debts

- Potential Risks and Considerations

- Steps to Apply for a 10K Debt Consolidation Loan

Understanding Debt Consolidation Loans: A Simple Guide

Debt consolidation loans are a popular financial solution for individuals burdened by multiple debts. This simple guide aims to demystify the process, especially when considering debt consolidation loans with no credit check. In essence, this type of loan combines several high-interest debts into a single, more manageable repayment schedule.

By consolidating your debts, you can reduce the stress of numerous due dates and potentially lower your overall interest rates. This is particularly beneficial for credit card debt, as it often carries higher rates compared to other loans. Moreover, with no credit check consolidation loans, individuals with less-than-perfect credit histories can still access this aid, providing them with a chance to improve their financial standing over time.

No Credit Check Loans: How They Work and Who Qualifies

Many individuals seeking debt relief are turned away due to their credit score. However, debt consolidation loans with no credit check offer an alternative solution for those who might otherwise be denied. These loans, as the name suggests, do not require a thorough examination of your credit history. Instead, lenders consider other factors to determine eligibility. This is particularly beneficial for folks with limited or no credit history, new immigrants, or individuals with poor credit who’ve had difficulty accessing traditional financing options.

Eligibility criteria typically include proof of income, employment status, and sometimes a co-signer. Lenders may also look at other financial obligations to ensure you can handle the additional loan payment. While it might seem counterintuitive, no credit check loans can be a stepping stone towards better financial health by simplifying debt management and providing access to funds for consolidation, allowing individuals to regain control of their finances.

The Advantages of Consolidating Your Debts

Debt consolidation offers numerous advantages for individuals managing multiple debts. By combining several loans into a single, often with lower interest rates, borrowers can simplify their repayment process and potentially save money on interest payments. This strategy allows for better financial management, as it reduces the stress of keeping track of multiple due dates and minimum payment requirements. Moreover, debt consolidation loans without a credit check provide an opportunity for those with less-than-perfect credit to access this service, offering relief from overwhelming debt burdens.

With a 10K debt consolidation loan, individuals can gain control over their finances again. The loan allows for the repayment of various debts, freeing up cash flow and providing a clear path to financial stability. This method can also enhance credit scores over time as it demonstrates responsible borrowing and on-time payments, which are key factors in building a solid financial profile.

Potential Risks and Considerations

While debt consolidation loans can offer numerous advantages, it’s crucial to also consider potential risks and factors before taking this step. One significant concern is the absence of a thorough credit check, which is often a standard practice in traditional lending. So-called debt consolidation loans with no credit check may sound appealing, but they come with higher risks. Lenders take on more uncertainty without assessing your credit history, which could lead to less favorable loan terms or even predatory lending practices.

Additionally, these loans might not be suitable for everyone. Individuals with a poor or limited credit history might struggle to secure the best rates and terms. It’s essential to understand that consolidating debt is a significant financial decision, and any loan should align with your long-term financial goals and capabilities.

Steps to Apply for a 10K Debt Consolidation Loan

Applying for a 10K debt consolidation loan involves several straightforward steps. First, compare different lenders and their interest rates to find the best deal. Many financial institutions offer debt consolidation loans with no credit check, making it accessible to those with varying credit histories. You can explore online platforms or visit traditional banks to gather information on terms, conditions, and repayment options.

Once you’ve chosen a lender, prepare necessary documents like income statements, tax returns, and identification proof. Complete the loan application form accurately, providing details about your existing debts and monthly budget. After submission, the lender will conduct an evaluation of your financial situation and creditworthiness. Upon approval, the funds will typically be dispersed directly to your account or via check, ready for debt repayment.

Debt Consolidation Loans with no credit check offer a viable solution for managing personal debt. By consolidating multiple debts into a single, more manageable loan, individuals can reduce monthly payments and potentially save on interest. This article has provided a comprehensive guide to understanding these loans, from their operation to the benefits they offer. While there are risks associated with any loan, carefully considering your financial situation and following the application steps outlined here can help ensure a successful outcome. Take control of your finances today by exploring 10K Debt Consolidation Loans as a potential path to debt freedom.